We are excited to inform you that Iagon has scheduled the commencement of a unique Liquidity Rewards Program, intended to recognize token holders who offer liquidity on recently added DEXes. The program is set to commence on April 21st as it was announced earlier.

It is set to unleash its power on the DEXes Minswap and Wingriders + we've added VyFinance and Spectrum Finance (since Nov,1st 2023), as well as the LSPO (Liquidity Stake Pool Offering) pool, in collaboration with the Norwegian crypto exchange, NBX & ADAnorthpool for additional rewards for those who participate.

In this article, we aim to clarify everything you need to know about the upcoming program and on how to participate in it.

We strive to offer competitive reward structures that will attract committed Liquidity Providers (LPs) and support the ongoing decentralization, growth, and development of our ecosystem. It's important to note that such initiatives also contribute to the wider adoption of the Cardano blockchain. Our aim is to sustain these efforts in the long term.

Over the last few months, the Iagon team has been focusing on developing the mechanism for the Liquidity Reward Program.

What are liquidity rewards?

Let's dive into the exciting world of liquidity pools, a crucial component of the decentralized finance (DeFi) ecosystem! These pools are reserves of cryptocurrencies locked in smart contracts, utilized for crypto exchanges. Each liquidity pool is composed of two tokens, hence the nickname "pair."

The creative minds behind these pools implement smart contract-based designs that enable them to operate as decentralized exchanges using the automated market maker (AMM) model. Unlike traditional order-book exchanges, crypto is traded through smart contracts, not with other users. The exchange rates are determined by mathematical formulas, creating a transparent and unbiased marketplace.

Liquidity Providers (LPs) are rewarded with shares in the pool that correspond to the volume of their deposit. Each time a swap occurs, a transaction fee is charged and distributed among the LPs, proportionate to their share of total liquidity. It's an ingenious system that benefits both LPs and traders alike.

What makes our Liquidity Rewards Program stand out?

Our Liquidity Rewards Program is designed to motivate our community to boost IAG/ADA liquidity. As an added bonus, participants who provide liquidity and delegate their tokens to our LSPO (Liquidity Stake Pool Offering) will receive exclusive Loyalty Bonuses.

Our goal is to incentivize our community to take an active role in the growth of our ecosystem, while rewarding their commitment and support.

Key highlights of the upcoming program:

- We've allocated a staggering 30 million IAG tokens for our Liquidity Program. Participants will be rewarded based on the amount of liquidity they provide and the duration of their participation.

- After the program ends, rewards will be distributed over the course of 12 months to ensure continued engagement and benefits.

- Participants in the LSPO will earn additional IAG rewards, enhancing the overall value of the program. Collected ADA from the pool will be used by Iagon team for further program enhancing (85% of ADA rewards from LSPO will be allocated towards providing liquidity, with half of the funds used to purchase $IAG tokens. The remaining portion will be used by team IAGON and can potentially be used in the future for Liquidity providers.)

- Get ready for something truly special - we'll be revealing exclusive NFT rewards in the near future, so keep your eyes peeled for more details!

Where to stake to get rewarded?

To participate in the Liquidity Rewards Program, there are two primary ways to participate:

- Provide ADA tokens to the LSPO pools by delegating them to the pool address

- 👉 IAGL2

Pool ID: cd0b7a6e8c22110113a9cffc266270e916a6e7ce2189917c70deebdd - link is here - 👉 IAGL1

Pool ID: pool1ztk6dcj2nc3plnujf3ek6jqngtx8hcryufz56lyumemlcy2xxn0 - link is here).

This will earn you additional IAG rewards from the Liquidity Program.

Our Liquidity Reward Program has seen a lot of interest.

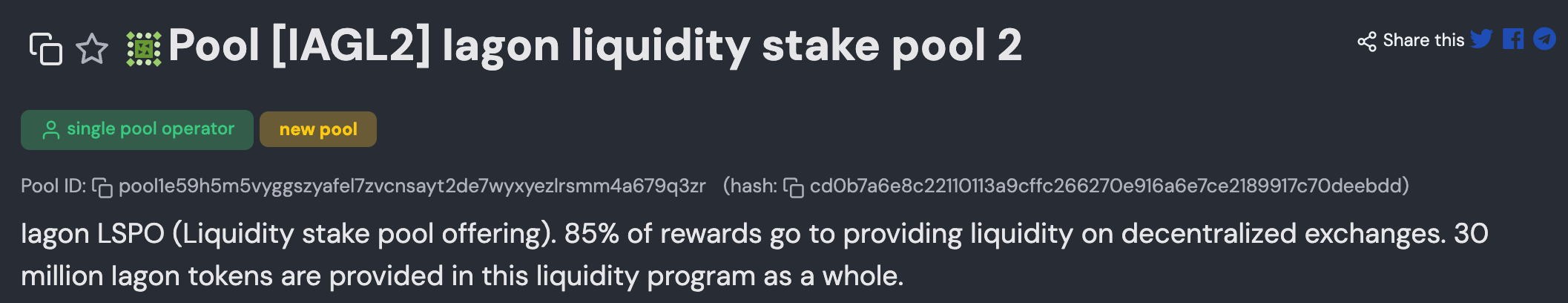

As IAGL1 pool is almost fully saturated. IAGL2 is now open for delegation. Delegate freely and join the momentum.

- Provide both ADA and IAG tokens on the verified pools of our partnered DEXes. By doing so, you'll earn rewards from the Liquidity Program in proportion to your share of the total liquidity. Make sure to keep an eye out for verified pools to ensure the security of your funds. Start earning rewards now and contribute to the growth and success of the Iagon ecosystem!

As already mentioned, we'll be collaborating with several DEXes on Cardano.

To participate, visit their website and look for the verified pools to start earning rewards.

- Minswap - https://app.minswap.org/liquidity

When selecting your tokens, be sure to choose IAG and ADA and double-check that they are verified to ensure your participation in the program. - Wingriders - https://app.wingriders.com/pools

- VyFinance - https://app.vyfi.io/

- Spectrum Finance - https://spectrum.fi/

In addition, there will be a LSPO pool in collaboration with the Norwegian crypto exchange, NBX and ADAnorthpool. Those who delegate there will be rewarded with additional bonuses.

Our official liquidity stake pools is already up. Check the correct name - the first one is IAGL1 - link is here.

Second pool is IAGL2 - link is here.

We have a user guide how to delegate to the pool, so feel free to read and explore - check the tutorial

Our commitment to the safety and security of our pool runs deep. We've left no stone unturned in our efforts to protect against potential supply chain attacks. We've rigorously tested for privilege escalations and subjected our pool to multiple rounds of security audits.

Our efforts don't stop there; we're constantly monitoring the performance metrics of our pool through automation and vigilant oversight. We've even gone the extra mile by setting up timesync devices and redundancies to ensure our pool runs like a well-oiled machine.

We take our responsibility seriously, and our users can rest assured that their assets are safeguarded at all times.

Liquidity Rewards Calculator

One more thing to mention is that we’re excited to launch our Liquidity Rewards Calculator - https://calculator.iagon.com/

With just a few clicks, you're able to see how your contributions can earn you rewards over time with several parameters:

- your stake period (length you stake your liquidity in the pool)

- amount you stake

- amount you delegate to LSPO pool (IAGL1)

This powerful tool takes the guesswork out of calculating your potential rewards and make it easier for you to understand the benefits of participating in our program.

How rewards will be calculated?

We understand that not everyone is interested in the technical details and complex calculations that go into our liquidity rewards program.

That's okay, because we're here to make things as easy as possible for you. If you're simply looking to participate and earn rewards for your liquidity, you can skip the technical jargon and focus on the simple steps for providing liquidity.

We want everyone to be able to participate and benefit from this program, regardless of their technical expertise. So don't worry if you're not a tech wizard - we've got you covered!

But below you can check technical and math details on how rewards will be calculated. We will use such reward computation function that would meet the following requirements:

- promoting longer locking periods;

- promoting higher locking volumes;

- allowing unlocking at any time (not necessarily continuous, perhaps once per epoch);

- providing an increase in terms of reward value (calculated in USD)

- monitoring the amount of tokens given out as rewards globally (the closer we get to the 0.5-3% limit, the slower the reward increase rate);

- Providing an additional boost for people delegating tokens as part of the LSPO.

The first two requirements suggest that the reward function should be superlinear in time and volume (if it was linear, there would be no difference between locking for many shorter periods and one longer period; the same can be said for locked amounts). If we consider the way continuous compounding of interest is handled, we could suggest an exponential relation i.e.:

where:

- A0 is the amount of locked tokens,

- t0 is the moment in time the tokens were locked,

- t is the moment of unlocking,

- Vt is the token value (e.g. in USD) at the moment of unlocking

(we divide by it to make the growth exponential in terms of value, not token amount), - α is the degree ofa.g. around 1.2m but this needs to be determined),

- β is the growth coefficient (to be determined as well).

Now, formula (1) is reasonable if the overall amount of tokens given out as rewards is far below the upper limit. When it begins to approach that point, we will need to start damping the exponential growth. The idea is to multiply the exponential component by another function that starts at 1 but tends to 0 as we reach the limit. One idea for such a function is:

where:

- Nr is the total amount of tokens given out as rewards so far,

- Nmax is the maximum allowed amount of tokens provided for rewards (i.e. 0.5-3% of the total token supply at the moment),

- γ is the damping coefficient (higher values of γ will make this component stick close to 1for longer, at the price of a steeper increase as we come near to the limit; lower values would make the initial drop more drastic).

Finally, we need another multiplicative term that reflects a person's participation in the LSPO. For someone not participating, this term should just be 1 and have no bearing on the overall reward. In the case of participants, it makes sense to consider their relative contribution (percentage). Two open questions (reflected by two additional parameters) are:

- What is the maximum reward boost for a hypothetical case of a sole participant?

- How should the increment due to LSPO participation grow with a growing percentage? Should it be linear, sublinear, superlinear?

This leads us to the following candidate function:

where:

- Pd is the fraction of a person's delegated tokens compared to the total volume (a real number between 0 and 1),

- ε is the coefficient determining how the LSPO increment depends on Pd (an ε of 1 would mean a linear relationship, higher values would favor high percentages disproportionately, and lower values would favor moderate participation),

- δ is a coefficient limiting the maximum reward boost due to participation in the LSPO (if δ is small, a hypothetical sole LSPO participant would see a drastic increase in their reward; if it's large, the LSPO effect on the overall reward is negligible; δ ≈ 2 translates to a boost by a factor of 1.5 in the extreme case).

The final reward function is the product of (1), (2), and (3):

For more information and other updates, please follow us on our social media , or head over to the IAGON Website!